The Playbook of Blue-chip NFTs

What defines a blue-chip NFT?

Probably a “I know it when I see it” question, to construct an NFT typology to answer this question is an intellectual waste of time, for what kind of metrics would you employ to delineate the ontology of a blue-chip?

Are historical NFTs, OG NFTs that is, like Cryptokitties and Etherrocks necessarily blue-chips? Is Azuki a blue-chip? Are NBA Top Shots blue-chips? If so, are they in the same category of blue-chips of BAYC and Cryptopunks? If blue-chips are to be definable quantitatively by some approximation of volume or marketcap or aggregate sales, is Axie Infinity a blue-chip? Are Beeples blue-chips? Is Loot, a zero-to-one invention still inspiring and breeding entire ecosystems, yet utterly unknown and unheard beyond the community of us cryptonerds a blue-chip, or even a historical?

Such philosophical musings are useless. What we do know is that a model is emerging. E Pluribus Unum. What one may call the BAYC model.

What is The BAYC model?

Perhaps it is more suitable to call it a playbook than a model, for no alternative model to accrue and generate value for the PFP NFTs has yet emerged.

This model has basically been outlined in the leaked Yugalabs deck. I would structure the model in these four parts:

Make NFT collection

Bootstrap Community

Airdrop Token

Post-bootstrap expansion

We can further expand the Community Bootstrapping phase into the following major components:

(I) Bootstrapping Exclusivity

(II) Build Crypto Street Cred

(III) Accumulate Normie Attention

(IV) Partnership and Activity Expansion.

Let us go through them in detail.

(I) Bootstrapping Exclusivity

Tie the NFT to access. Something. Anything. However minimal or silly the object that is granted access to might be. This generates exclusivity, which can then be further leveraged. Exclusive access to features generates hold pressure, and external interest. Most of us are at the very least mildly interested in what it is to be like to have a Divine Role. Exclusive access is minimal viable utility - MVU.

(II) Build Crypto Street Cred

This is perhaps the first step to bootstrap your community. You must start with crypto people. You must earn their trust. They are the only people you’ve got at this point.

Well-known individuals in the crypto community holding an Bored Ape include Ivan Soto-Wright (CEO of Moonpay), Pranksy, JRNY Crypto, Alexis Ohanian, Faze Banks, Deepak, Gary Vee (CEO of Vayner Media) , Taylor Gerring, Garry Tan, Roham, and more.

And this is the reason why the NFT must be PFPs. An NFT of a picture is, as the critics say, utterly useless. Being able to show it on one’s twitter profile, is the minimal use you can generate. And from that, springs memetic value. The fact that an NFT collection begets derivatives and copycats is proof of supply of memetic value not meeting demand, and therefore no sane team building a NFT collection would go after a derivative or copycat collection. It will be as silly as the Japanese government going after manga and anime piracy.

And of course, hacks involving Apes would only increase the value of the collection. The Mona Lisa only became the world’s most famous painting after getting stolen. Involve even more people by dropping official derivative-generating NFTs, like Serum, which when combined with Bored Apes would generate Mutant Apes. There, you have doubled your community, sales, and royalty intake. Take the serum, take the Red Bean.

(III) Accumulate Normie Attention

Display them in Times Square, feature them on the Tonight Show with Jimmy Fallon, let them hate. No press is bad press.

BAYC eventually got celebrities involved in the brand. There was no shortage of rumour that to achieve this they even gifted Apes to them for free just for their star and celeb power.

And to this end, BAYC has amassed an impressive list of artists, athletes, rappers, socialites, celebrities, and socialites, including: Serena Williams, Justin Bieber, Mark Cuban, Steph Curry, Shaq, Lil Baby, Timbaland, Jimmy Fallon, Paris Hilton, Future, Post Malone, Diplo, DJ Khaled, Snoop Dogg, Eminem, Steve Aoki, Meek Mill, Ja Rule, Neymar, Travis Barker, Gwyneth Paltrow, Ben Simmons, Logan Paul, The Chainsmokers, Dez Bryant, Von Miller, Rolling Stones, and more. (IV) Partnerships and Activity Expansion.

Build partnerships! Sleep with the big boys. In the days before WWI, lesser aristocrats, new and lesser monarchies (like that of Yugoslavia) would marry into more ancient houses to better their position. Pull a Victoria if you can. Roll out merch after merch after merch! Make yourself into the symbol of human decadence of 21st century capitalism.

Host themed festivals, complete with yachts, parties, more merch, live music, and charity donations. Max out all capacity. Who doesn’t like Burning Man?

And of course, because the BAYC IP is so configured such that each Ape represents its own JPEGs entire IP, owning an Ape basically means you can do whatever one can with any IP. Make a film out of it if you can. Heck, even a themed restaurant.

Once you have done enough rounds of that, eventually, it is time to do the token airdrop.The $APE Airdrop

The $APE token became claimable by any holders of BAYC and MAYC on the 17th March, 2022. Most airdrop tokens usually just crash immediately, followed by a dead-cat bounce, and then more dumps, and so on.

And in anticipation of this we saw heavy shorting on $APE, which was only dramatically followed by gargantuan liquidations as the token underwent into a short squeeze. Indeed, on the second day of trading, Ape surged by 90%.

You can see there’s massive negative funding on the first day as represented by the neon blue line.

18th March, 16.56mm shorts liquidated.

As $APE went parabolic into the second day, highly leveraged shorts got liquidated, pushing the price higher.

In contrast to some notable airdrops such as the $WTF token for fees.wft and $AGLD for loot holders, $APE’s price trajectory does not seem to have followed their price trajectory. The pump on the second day was higher than many bars of the previous day. A contrary opinion might say, perhaps we are still in early days, and that this analysis has improperly discounted the massive red-candle on the first day (in which this writer remembers the high was actually $40), and that the pump to new highs on the second day was indeed the dead cat bounce we saw in $WTF and $AGLD. Reasonable as that might be, the trading sentiment in those crucial hours was one of spectacular frustration. Crypto twitter went through a violent outpour of “why won’t you die” tweets. God knows how many were shorting it, yet the token refused to dump. And in the short squeeze, the price catapulted.

The success of $APE to defend its price in face of heavy shorting probably offers valuable lessons for any NFT token airdrop. Here are some of the reasons behind $APE’s successful defense of their price - some speculative, some not.

(i) Strong community, Strong brand, Strong backers: the fact that the BAYC has become practically a household name, and that the project has already produced a track record of building. So confidence is high, and there is strong belief that the token’s utility will emerge soon. Strong backers from Animoca and A16Z also definitely helped further bolster confidence.

(ii) The Yugalabs deck leak: the leak definitely clarified the roadmap for everyone. It also generated more hype and gossip in both crypto and traditional media. Questions about utility and long term vision were dispelled.

(iii) Massive Liquidity from CEXes: $APE has managed to secure listings on a very impressive list of centralized exchanges, including Binance, FTX, OKEx, KuCoin, Gate.io, Crypto.com and Huobi, on top of Uniswap and SushiSwap. This allowed the huge amount of selling pressure to be taken off by retail buyers and speculators. Being listed on CEXes also enabled perp-trading, and that paved the way for the short-squeeze to invalidate the collapse thesis.

The Logic of a Luxury Brand

For BAYC is quickly becoming a cultural icon, a luxury brand. It is for this very market development trend that FTX has hired Lauren Remington Platt to work on partnerships with luxury and fashion brands. Luxury is a $300 billion market. The value of NFTs exchanged in 2021 was $24.9 billion. There are surely going to be many more blue-chip NFTs to come.The playbook has been written, and we see a couple of NFT collections following its wisdom, including MOAR and Fwenclub, Azuki, Cryptokitties, and Kiwami. Some notable NFT collections that do not seem to fit the BAYC model include Etherrocks, London, by Proof of Beauty, Biblically Accurate Angels, fiveoutofnine, Frankfrank, Autoglyphs, Beeple’s work, and Gen.Art.

These NFTs are either art, proof-of-concept implementations, or just nonsense made of the purest meme atoms. They do not abide by the BAYC playbook. Why should they? There is no reason to. Having said that, it is not clear what their playbook is. If we understand blue-chips as any NFT collection has attained luxury brand status, then the following are almost definitely true of the collection:

(I) The collection has to be PFPs: This we have re-iterated many times. It is crucial for them to build their initial community, and to accrue memetic value.

(II) No two blue-chip NFT collections can share the same “traits”: artistic genre, theme, and characters. If you’re too similar to an existing NFT collection, you risk looking like a derivative, a copy-cat, a free-rider. For this reason, Kiwami is actually in a rather precarious position.

(III) It must have copy-cats.

Given (II) one can sort of guess what next NFT collection could become a blue-chip. It has to be something nobody has done before. It cannot be too similar to something that already exists.

(II) and (III) are deeply related. The existence of copy-cats is proof of demand for the original NFT collection. Adidas, Nike, Reebok, Puma, all have copy-cats, and so do LV, Polo, Ralph Lauren, and Gucci. But not just that, the existence of copy-cats, I would argue, serves a vital function in propping up the original NFT community. It allows more individuals into the periphery of the club, spreading the mania over a larger group of people. If there aren’t enough people, the floor would simply collapse. Why did Beanie Babies fail? Primarily because there is no utility. It cannot generate continuous need. Need generates interest, interest generates passion, passion generates obsession. Obsession is fuel for that market for irrational people. The exclusive access and privileges granted by BAYC ownership is the utility, and the copy-cats allow there to be enough people so that the irrationally obsessive ones would filter through into the core, who will eventually buy a real Bored Ape, propping up the price. There could be no collectible legos if there is no huge lego community, and there could be no huge lego community if poor people cannot play with them with the fake ones. The exclusive privileges enjoyed by the core original NFT holders are then made valuable by the envy of those who are as close to the club as mercury is close to the sun, then the interest of the periphery, and then the curiosity of the unevangelized Oort Cloud (Crowd).

It is out of this logic that BAYC produced the Serum collection to produce Mutant Apes, and why Azuki had Beanz. These are strategies to expand the collector population, to flex the exclusive privileges granted by Bored Ape ownership. Lamborghini only produced 40 Centenario(s). 20 Coupe and 20 Roadsters. It’s a very rare and exclusive car, therefore only special owners that could get one of these. To buy a Centenario, you need to be a loyal customer to Lamborghini in the first place. And of course, the regret suffered by those who sold their Apes too early would only further strengthen the desirability of the Ape.

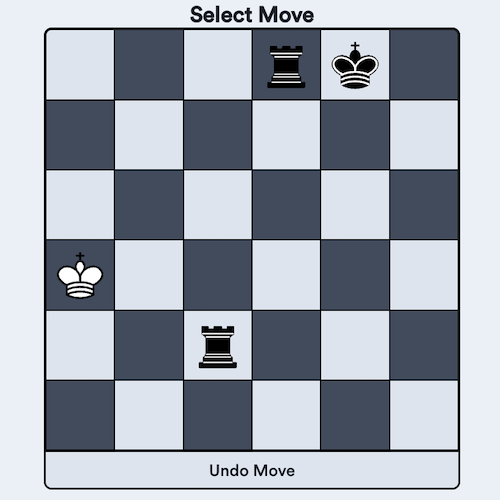

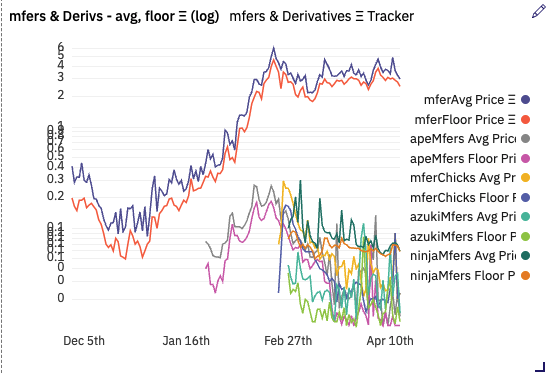

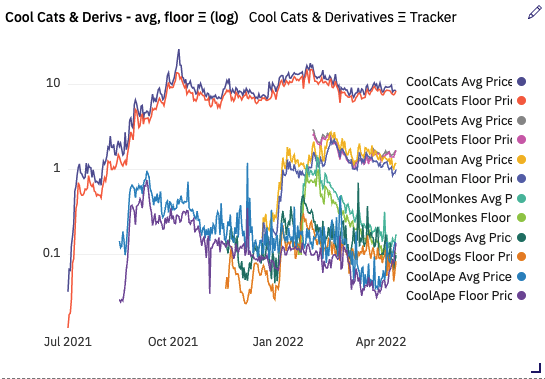

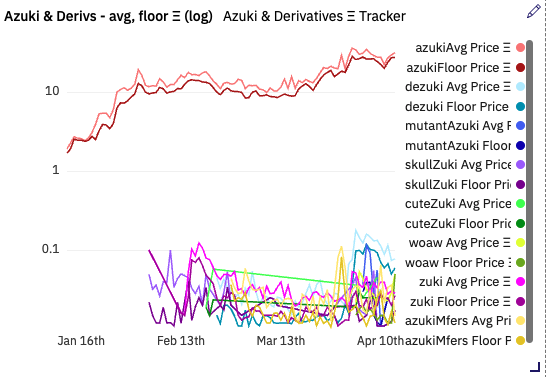

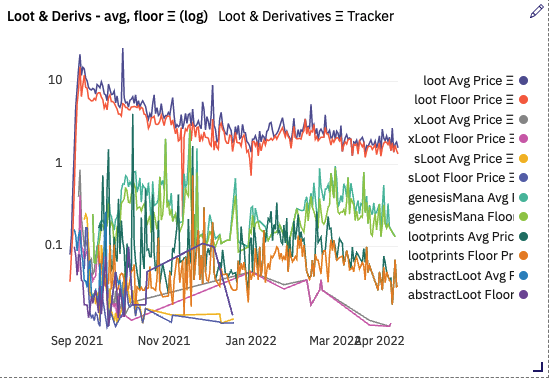

Although copycats play a crucial role in sustaining the life of the original NFT, they do not enjoy the upside. We can see this in this dashboard we have built on the price data of blue-chip copycats.

As you can clearly see, none of the copycats could manage an upward trajectory in orbit with the original’s price pump. Only the official “copycat” (“derivative” is more appropriate) managed to stay in orbit. We observe a similar phenomenon in mfers, coolcats, azuki, even loot.

Caveat emptor.

Summary

A playbook for blue-chip NFTs has emerged.

By that playbook, blue-chip NFTs should eventually emerge as luxury brand objects.

Given the size of the luxury brand market, we can expect many more blue-chips to emerge in the future. Mane tamen.

NFT token airdrops are nasty business. You need access to massive retail liquidity to not screw things up.

By that playbook, blue-chip NFTs must be PFPs.

That playbook makes no sense for non-PFP NFTs.

And to be blue-chips, they must not risk looking too similar to existing blue-chips.

Copycats are copycats are copycats. They do not end well.